If you are new to Excel, this video is for you. It shows how to set up budget templates that are easy to customize. It will help you create customized budgets for your different departments or projects. Set up budget templates in Excel that are easy to customize and update. This post shows you how to set up a basic template that is easy to customize and update. Then we’ll show you how to make it even easier by using a plugin for Excel that allows you to create custom budget templates. You don’t need any special knowledge or programming skills to use this method.

Creating budget templates is essential when you’re running a small business. You need to know how much money you’ll spend every month. A budget template lets you track your expenses over time and help you stay on top of your finances. But a template doesn’t have to be complicated. You can create a simple budget template that’s easy to update and customize. We’ll walk you through the steps to set up a basic budget template that’s easy to customize and edit in this post.

Creating budget templates is essential when you’re running a small business. You need to know how much money you’ll spend every month. A budget template lets you track your expenses over time and help you stay on top of your finances. But a template doesn’t have to be complicated. You can create a simple budget template that’s easy to update and customize. We’ll walk you through the steps to set up a basic budget template that’s easy to customize and edit in this post.

Creating budget templates can be daunting. There are so many different things that need to be included in a template, and if you try to do all of them, you’ll probably end up overburdening yourself, and your budgeting process will get out of control. This post will give you step-by-step instructions on setting up a simple spreadsheet template in Excel that makes it easy to customize for your budgeting needs.

What are budget templates?

Budget templates are simple spreadsheets that are usually used to track spending. They are often used by businesses that want to stay on top of their finances and track how much money they spend every month. Budget templates are a tool that helps you to quickly and easily see where you’re spending your money. Once you create the template, you can add it to your company’s accounting software. Then, you can see a snapshot of your spending at any given time. Budget templates also help you predict your future spending and prepare for the unexpected. You can keep track of your expenses and set goals to save money.

How to use budget templates

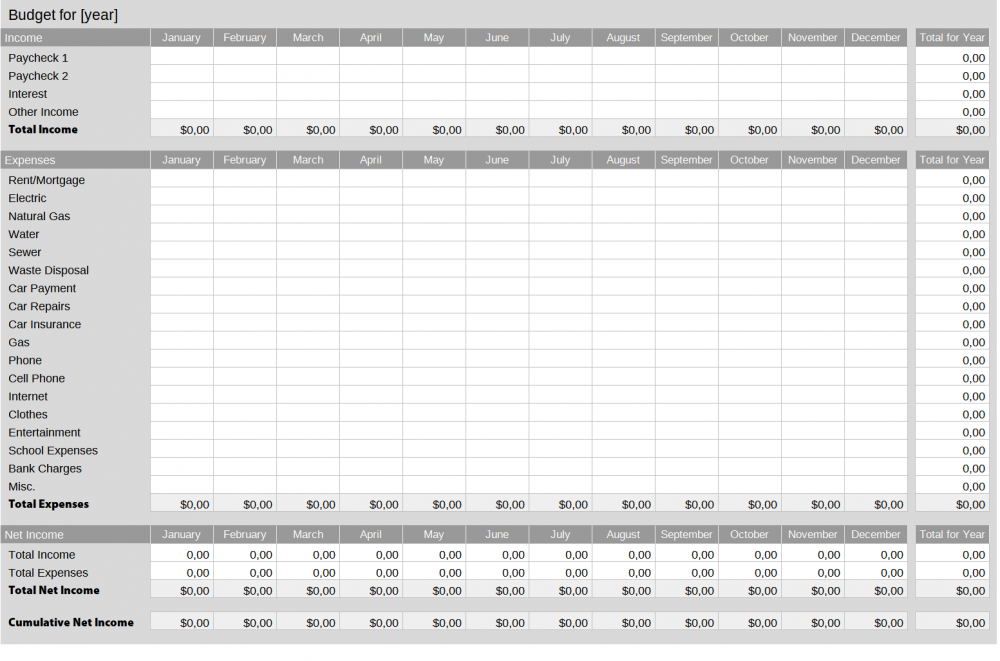

One of the best ways to manage your finances is using budget templates. These are also known as expense tracking spreadsheets. They keep track of how much money you’re spending and what you’re spending it on. While there are many budget templates, most aren’t easy to use and don’t give you enough flexibility. So I decided to create my own. You can download my budget template here or watch the following video to see how it works. If you want to learn how to use the template, follow the steps below.

Step 1: Install Excel

If you don’t have Excel already installed on your computer, you can download it from Microsoft.com.

Step 2: Open the template

Click on the file name. The template will then open in Excel.

Step 3: Enter your data

Fill out the columns as you would any spreadsheet. You can add columns and change the column names to suit your needs.

Step 4: Save the template

Click on the File tab, then click on “Save as”. Choose a location where you can access the template. You can then name the template whatever you’d like. That’s it! You now have a budget template that you can use to track your expenses.

What are the most popular types of budget templates?

Budget templates are helpful because they allow you to easily track your spending and keep track of where your money goes. These templates are helpful for businesses of any size. However, they’re instrumental if you’re running a small business. A budget template is a simple spreadsheet containing a table of contents with columns corresponding to categories. Each row represents a category. The numbers in each cell represent the amount you spend in that category. Most budget templates are designed so that you can add new categories and modify existing ones. They also include formulas that calculate totals. If you’re running a small business, you might want to keep track of your costs for several categories. For example, you might want to track the following categories:

* Rent

* Utilities

* Marketing

* Technology

* Insurance

You can also include other categories such as employee salaries, training, etc. This guide shows you how to set up budget templates in Excel that are easy to customize and update.

What are some examples of budget templates?

Budget templates can be created with just a few clicks. It’s easy to customize, and you can easily update the data. Some budget templates are built for a single user, while others are designed for multiple users. You can find budget templates on the internet, but most are made for Windows. However, you can find budget templates explicitly created for Excel. For instance, you can make a template that you can use for your own personal finances, or you can make a template that you can use for your business.

What should I include in budget templates?

You can use any budget template that you want, but there are some standard features you should look for. For example, most budget templates come with a date range and a summary line. You’ll usually need this because you’ll be tracking your spending over time. Additionally, you’ll want to be able to track your expenses by category. For example, you might have a line for “office supplies” and another line for “rent.” You can also use budget templates to track your income. For example, you might have a line for “revenue” and another line for “expenses.” This will let you see if you’re losing money or making more than you expected.

How to choose budget templates

When you’re starting, you probably won’t have much money. You’ll need to make do with what you have, so you’ll need to spend wisely. It would help if you started by choosing budget templates that fit your personal needs and the needs of your business. For example, if you plan to buy many things on Amazon, you might want to choose a template that shows your purchases in the spreadsheet. If you plan to go out a lot, you might want to choose a template that shows your expenses over time. As you grow, you can expand your budget templates. For example, you can add a template that shows your monthly spending.

Why should you create budget templates?

Creating budget templates is essential when you’re running a small business. You need to know how much money you’ll spend every month. A budget template lets you track your expenses over time and help you stay on top of your finances. Here’s how it works. You create a monthly budget and template and then add your monthlies. Every month, you enter the new expense, and the total goes up by the amount you’ve added. If you want to track the progress of your business over a more extended period, you can set up a quarterly budget template. Like a monthly budget template, you track your expenses for each quarter and then add them up at the end of the year. Now that you’ve created a budget template, you can use it to keep track of your expenses. You can also use it to create reports for your accountant.

Google Adwords Budget Templates

Budget templates let you track your Google Adwords spending over time and help you stay on top of your finances. They’re simple, customizable, and update-friendly. Here’s how to set them up:

1. In the leftmost column, enter a date. If you don’t know when you’ll start tracking your spending, you can enter today.

2. In the middle column, enter the amount you’ll spend this month.

3. In the rightmost column, enter the amount you’ll spend next month.

4. If you want, you can change the units from $ to £ or €.

5. Click on “OK.”

As you can see, budget templates are straightforward to use. Once you’ve created one, you can copy and paste it into any other spreadsheet you’re working on.

Frequently asked questions about budget templates.

Q: How important are budget templates to you? Why?

A: Budget templates are significant to me. I use them for everything from my everyday expenses to my business expenses. If you aren’t using a template, you are losing a lot of money!

Q: Do you know of any other ways to manage your finances better than with a budget?

A: I haven’t found anything else. It’s just so easy and convenient. You can enter the amounts into your budget, and it tells you precisely what each part is for.

Q: How did you go about creating your budget? Did you make it up yourself?

A: I made it up myself. I used the accessible version of Excel, and I added all of my accounts. Then, I took the data from each report and added it to a new sheet within the spreadsheet. This way, I could easily change the numbers if I wanted to, without going back and updating them every time.

Q: So this is how you manage your expenses?

A: Yes, this is how I manage my expenses.

Myths about budget templates

1. Budget templates are only helpful for businesses with a sales team.

2. Budget templates only work for small businesses.

3. Budget templates are only valid for companies with less than $1 million in annual revenue.

4. Budget templates don’t have to be expensive.

5. Budget templates can only be used to predict budgets for the following year.

6. Budget templates can only be used for forecasts.

Conclusion

Budget templates are a great way to organize your finances. You can set them up with a few mouse clicks and customize them to suit your needs. If you need a budget template like this, you can download it for free by clicking the image below! I created this budget template to help me save money and stay organized.